4 Simple Techniques For Guided Wealth Management

Table of ContentsEverything about Guided Wealth ManagementNot known Facts About Guided Wealth ManagementLittle Known Questions About Guided Wealth Management.Facts About Guided Wealth Management RevealedExamine This Report about Guided Wealth ManagementThings about Guided Wealth Management

Choosing an efficient monetary consultant is utmost important. Do your research and spend time to examine prospective monetary advisors. It is appropriate to place a huge effort in this process. So, perform an evaluation amongst the candidates and pick the most certified one. Consultant duties can vary depending on several aspects, including the sort of financial advisor and the client's needs.A restricted advisor needs to proclaim the nature of the restriction. Giving proper strategies by analyzing the history, economic data, and capacities of the client.

Assisting customers to execute the economic plans. Routine monitoring of the financial portfolio.

If any type of problems are encountered by the management experts, they figure out the root creates and fix them. Build an economic danger assessment and assess the possible result of the threat. After the completion of the danger analysis model, the adviser will assess the outcomes and give an appropriate remedy that to be implemented.

Some Known Facts About Guided Wealth Management.

They will certainly assist in the achievement of the economic and workers goals. They take the duty for the offered choice. As an outcome, customers need not be concerned regarding the choice.

But this led to an increase in the internet returns, price savings, and also assisted the path to success. Several procedures can be contrasted to recognize a certified and skilled advisor. Usually, consultants need to fulfill basic scholastic certifications, experiences and certification recommended by the federal government. The standard academic credentials of the advisor is a bachelor's level.

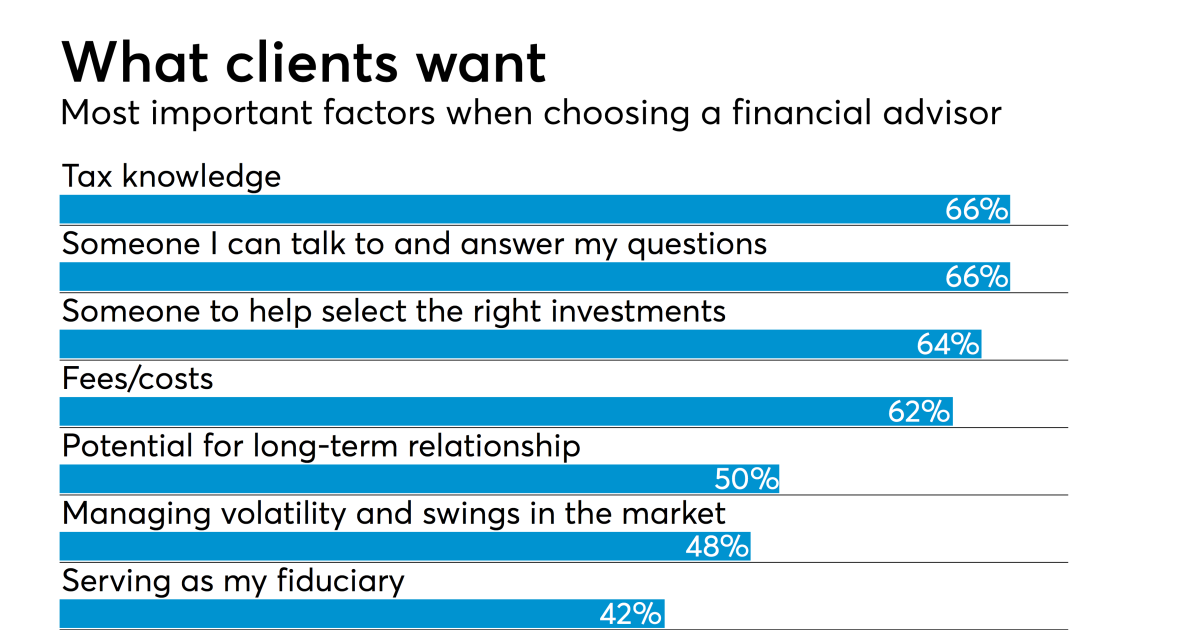

While looking for an expert, please think about credentials, experience, skills, fiduciary, and repayments. Browse for quality till you get a clear idea and full fulfillment. Always make sure that the guidance you receive from a consultant is constantly in your benefit. Eventually, monetary experts maximize the success of a company and likewise make it grow and flourish.

Guided Wealth Management for Dummies

Whether you require somebody to aid you with your taxes or stocks, or retired life and estate preparation, or every one of the above, you'll find your response here. Keep checking out to discover what the distinction is between a financial consultant vs coordinator. Basically, any kind of specialist that can assist you manage your cash in some fashion can be considered an economic advisor.

If your goal is to create a program to fulfill lasting monetary objectives, after that you most likely intend to employ the services of a licensed economic organizer. You can look for an organizer that has a speciality in taxes, financial investments, and retired life or estate preparation. You may also ask regarding classifications that the organizer lugs such as Certified Monetary Coordinator or CFP.

A monetary expert is simply a wide term to define a professional that can assist you handle your money. They might broker the sale and purchase of your supplies, manage investments, and help you develop a thorough tax or estate strategy. It is very important to keep in mind that an economic consultant ought to hold an AFS certificate in order to offer the public.

The Main Principles Of Guided Wealth Management

If your economic consultant listings their services as fee-only, you must anticipate a listing of solutions that they provide with a failure of those charges. These professionals do not supply any type of sales-pitch and typically, the services are cut and dry and to the point. Fee-based consultants charge an ahead of time charge and after that gain payment on the economic products you buy from them.

Do a little research initially to be sure the financial advisor you work with will certainly be able to take treatment of you in the long-lasting. Asking for references is a good means to get to recognize a monetary consultant before you even meet them so you can have a better idea of just how to handle them up front.

Indicators on Guided Wealth Management You Should Know

You need to constantly factor costs right into your economic planning situation. Carefully evaluate the cost frameworks and ask inquiries where you have confusion or worry. Make your potential expert address these concerns to your complete satisfaction before moving onward. You may be looking for a specialty advisor such as somebody that concentrates on separation or insurance policy preparation.

A monetary advisor will certainly assist you with setting possible and realistic goals for your future. This might be either beginning a business, a household, preparing for retirement all of which are essential chapters in life that need careful consideration. An economic consultant will take their time to review your situation, short and long-term objectives and make recommendations that are best for you and/or your household.

A research from Dalbar (2019 ) has illustrated that over twenty years, while the average financial investment return has actually been around 9%, the typical investor was only getting 5%. And the difference, that 400 basis points each year over 20 years, was driven by the timing of the financial investment decisions. Handle your portfolio Secure your possessions estate preparation Retirement intending Manage your incredibly Tax obligation financial investment and administration You will be needed to take a danger tolerance survey to supply your consultant a more clear image to establish your investment possession allocation and preference.

Your consultant will certainly analyze whether you are a high, medium or low threat taker and established a property allotment that fits your danger tolerance and capacity based upon the information you have provided. A high-risk (high return) individual might invest in shares and residential or commercial property whereas a low-risk (reduced return) individual might desire to invest in cash money and term down payments.

The Single Strategy To Use For Guided Wealth Management

The much more you conserve, you can select to invest and build your riches. When you involve a financial expert, you do not have to handle your profile (financial advisor redcliffe). This conserves you a lot of time, initiative and energy. It is necessary to have correct insurance coverage which can offer peace of mind for you and your family try this members.

Having a monetary advisor can be incredibly advantageous for many individuals, yet it is very important to evaluate the pros and disadvantages before making a decision. In this short article, we will certainly explore the advantages and negative aspects of dealing with an economic expert to assist you make a decision if it's the right move for you.

Comments on “The Basic Principles Of Guided Wealth Management”